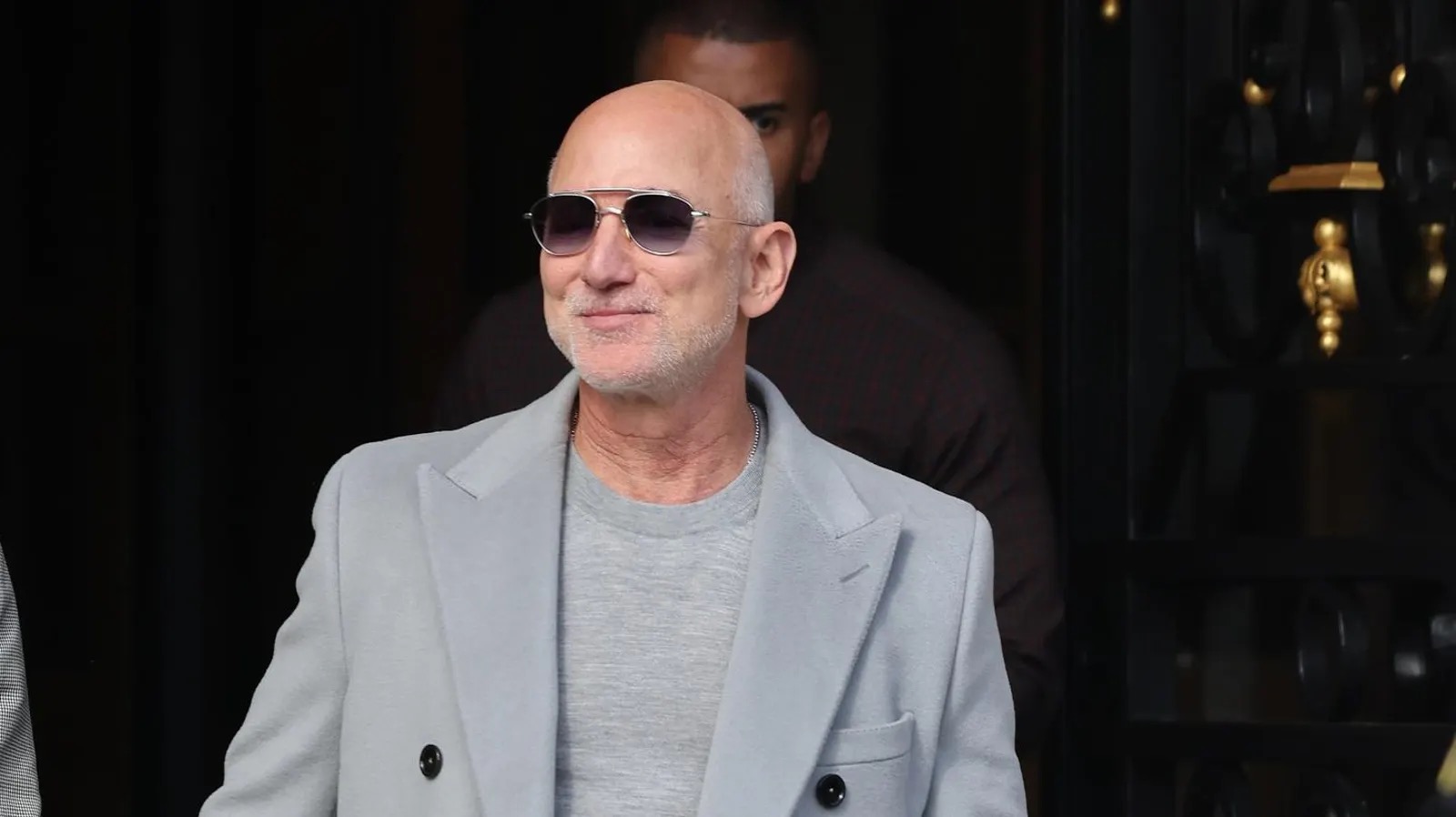

Jeff Bezos, the founder and executive chairman of Amazon, saw his net worth surge by an astonishing $10 billion in a single day after Amazon’s stock skyrocketed on news of a landmark deal between Amazon Web Services (AWS) and OpenAI. The partnership, valued at around $38 billion over seven years, marks one of the most significant cloud-computing agreements in recent memory and cements Amazon’s position as a central player in the global race for artificial intelligence infrastructure.

A Record-Breaking Day on Wall Street

Amazon shares climbed nearly 5% on Monday following the announcement, closing at an all-time high and adding hundreds of billions to the company’s market capitalization. The sudden jump in stock value translated directly into a windfall for Bezos, who still holds roughly 8–9% of Amazon’s outstanding shares despite selling portions of his stake over the past few years.

That single-day rise added close to $10 billion to his personal fortune, pushing his estimated net worth to more than $260 billion and reaffirming his status as one of the richest people in the world. The surge represents one of the largest one-day increases in personal wealth recorded for any billionaire in recent years.

The markets reacted enthusiastically to what analysts described as a “transformative” partnership between Amazon and OpenAI, viewing it as a sign that Amazon is reasserting its dominance in the cloud-computing and AI infrastructure space—a market increasingly seen as the backbone of the next decade’s technological growth.

The Strategic Importance of the OpenAI Partnership

Under the new agreement, OpenAI will rely heavily on Amazon Web Services to power its next generation of artificial intelligence models and products. The deal reportedly includes long-term commitments for compute power, cloud storage, and access to specialized high-performance chips designed for large-scale AI workloads.

For OpenAI, the partnership ensures access to one of the world’s most scalable and secure cloud infrastructures, enabling the company to accelerate development of its advanced AI systems. For Amazon, it represents a massive commercial victory in the escalating battle for AI infrastructure dominance—a competition that also involves Microsoft’s Azure platform and Google Cloud.

Industry analysts noted that this partnership not only reinforces AWS’s reputation as a technological leader but also signals Amazon’s determination to integrate artificial intelligence more deeply into every layer of its business. AWS has long been Amazon’s most profitable division, and the OpenAI deal could significantly boost its long-term revenue streams by tying it to the most prominent AI research and deployment organization in the world.

Bezos’ Enduring Connection to Amazon’s Fortunes

Even though Jeff Bezos stepped down as Amazon’s CEO in 2021 to focus on other ventures—including his space exploration company Blue Origin and various philanthropic efforts—his personal wealth remains tightly linked to Amazon’s stock performance. The recent rally demonstrated how quickly market sentiment around Amazon’s innovation strategy can affect his net worth.

Bezos’s ownership of approximately 8–9% of the company makes him uniquely exposed to market swings. When Amazon shares move by a few percentage points, billions of dollars can be added—or erased—from his fortune overnight. The OpenAI announcement ignited investor confidence that Amazon’s AI and cloud strategy could yield sustained growth and higher profit margins, driving the stock’s sharp rise.

This latest increase underscores a broader trend: even in semi-retirement from daily operations, Bezos continues to be one of the biggest beneficiaries of Amazon’s evolution and its ability to adapt to the changing technological landscape.

Investor Confidence and Market Implications

The deal comes at a time when investor enthusiasm for artificial intelligence remains at fever pitch. Over the past two years, companies positioned at the center of the AI supply chain—semiconductor manufacturers, cloud providers, and AI software developers—have seen their valuations skyrocket. The OpenAI partnership positions Amazon squarely in that high-growth ecosystem, promising to capture significant revenue from the surge in demand for AI computing power.

Market analysts interpret the deal as a signal that Amazon is no longer content to play second fiddle to Microsoft, whose deep integration with OpenAI via Azure had previously given it a strategic advantage in cloud-based AI. Now, with this new partnership, Amazon is poised to reclaim leadership in providing the infrastructure needed for generative AI and machine learning applications.

Investors also see the deal as an opportunity for Amazon to diversify and strengthen its high-margin businesses. While e-commerce continues to be the company’s largest revenue generator, AWS has long been its primary profit engine. The addition of AI-related contracts could boost AWS’s profitability even further, potentially adding billions to Amazon’s bottom line in the coming years.

Broader Context and Future Outlook

Beyond the immediate financial implications, the partnership underscores a broader shift in how major technology companies are aligning themselves for the next wave of digital transformation. Artificial intelligence is rapidly becoming the most important growth driver for Big Tech, reshaping everything from cloud infrastructure to consumer applications.

For Amazon, this deal also provides a strategic advantage in its own internal AI initiatives. The company has already begun integrating generative AI tools into its retail, logistics, and entertainment divisions. The close collaboration with OpenAI will likely accelerate that integration, providing Amazon with firsthand access to emerging AI technologies and methodologies that could enhance productivity across its operations.

For Jeff Bezos, the $10 billion wealth surge serves as both a reminder of his enduring influence and a validation of his long-term vision for Amazon. Even though he no longer manages day-to-day operations, the company’s strategic direction—particularly its commitment to technological leadership—still reflects the culture of relentless innovation he helped build.

Conclusion

Jeff Bezos’s massive one-day fortune increase may make headlines, but the real story lies in Amazon’s strengthening position within the AI ecosystem. The OpenAI partnership marks a pivotal moment in the global competition for AI infrastructure and signals a new era for Amazon—one defined not by retail dominance alone, but by leadership in the computational backbone of artificial intelligence.

As investors celebrate the immediate gains, the broader implications reach far beyond Bezos’s personal wealth. This deal reaffirms that the future of Big Tech—and perhaps the global economy itself—will be powered by AI, cloud computing, and the visionary companies capable of binding the two together.

With Amazon now firmly back in the AI spotlight, Bezos’s fortune may have risen $10 billion overnight—but the value of this partnership could ultimately prove far greater.