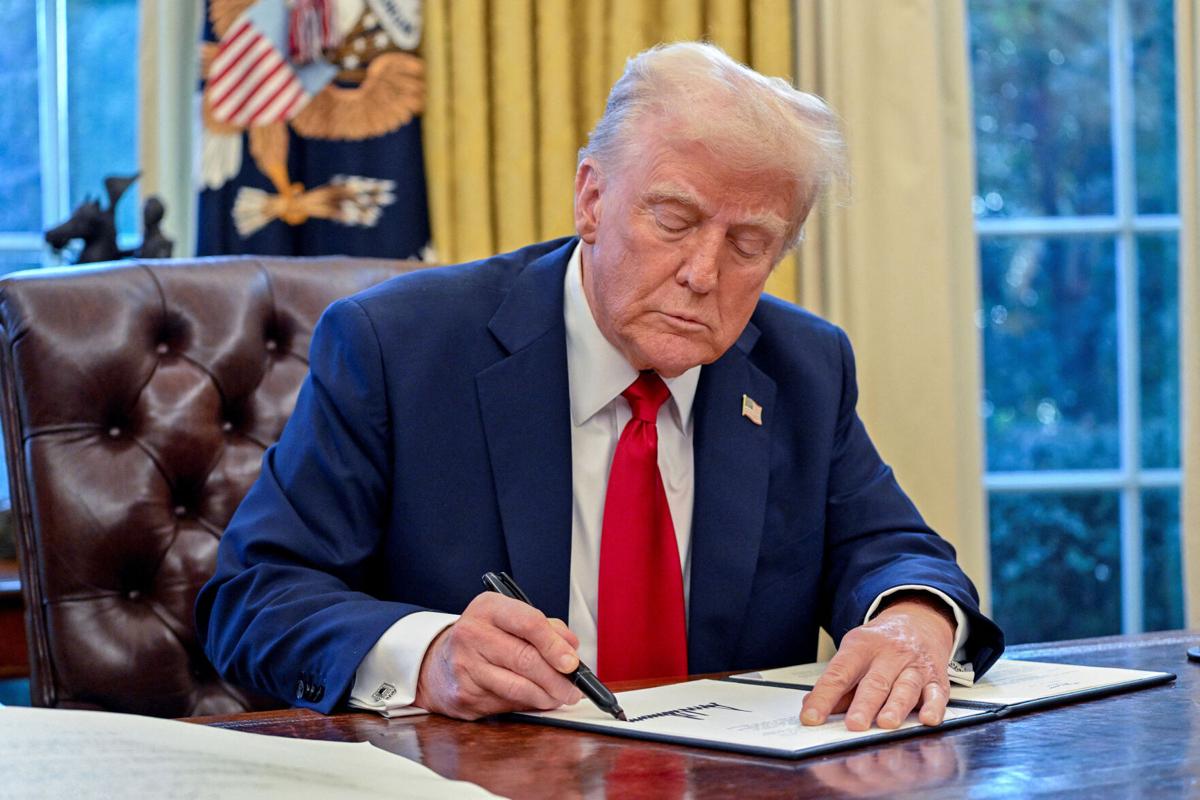

President Donald Trump has significantly expanded his already substantial investment portfolio with the purchase of another $82 million in corporate and municipal bonds, according to recently released financial disclosures. The transactions, carried out over several weeks in late summer and early fall, add to what has become a pattern of heavy bond accumulation since his return to the White House. While the purchases appear to be part of an ongoing strategy to diversify and stabilize his personal assets, the volume and timing of the investments are once again prompting scrutiny from ethics watchdogs and political analysts.

The new filings show that Trump made more than 175 individual bond purchases in the span of just over a month. These include both corporate bonds—issued by major American companies across sectors such as technology, finance, retail, and manufacturing—and municipal bonds tied to funding for school districts, public utilities, hospitals, transit systems, and local government services. Though the mandatory disclosure format provides wide value ranges rather than precise amounts, the minimum total of all transactions clears $82 million, while the maximum theoretical value is several times higher.

Trump’s investment portfolio has always been diverse, heavily weighted toward real estate, hospitality, and branding. But since taking office again, he has increasingly shifted toward fixed-income securities, buying tens of millions of dollars’ worth of bonds in recurring batches every few months. In the view of financial strategists, the strategy is fairly conventional: bonds offer stability, steady income, and a hedge against volatility in equity markets, which have swung sharply during parts of the year due to shifts in interest-rate policy, global trade tensions, and questions about overall economic growth.

Still, the volume of these latest purchases is drawing attention not simply because of their size, but because of the intersection between Trump’s personal finances and his political power. Many municipal bonds, for example, fund state and local projects that are directly affected by federal funding decisions. Corporate bonds, meanwhile, represent loans to major companies—some of which operate in industries whose fortunes can rise or fall based on federal regulatory policy, tariff frameworks, or government subsidies. For critics, this overlap raises the possibility, or at least the appearance, of conflicts of interest.

The White House has stated that Trump does not personally direct day-to-day investment decisions and relies on a third-party financial manager to handle purchases and allocations. Supporters argue that this setup is intended to prevent Trump from having advance or selective knowledge about specific trades. They also note that bond purchases, unlike stock trades, typically reflect long-term holdings rather than speculative moves. However, skeptics question how much distance truly exists between Trump’s policy decisions and the investment activity carried out on his behalf, especially when billions of dollars in federal spending or regulatory shifts could directly affect the issuers of the bonds he owns.

Among the corporate issuers represented in the new disclosures are several of the largest and most influential U.S. companies—names in technology, finance, manufacturing, and consumer goods. While investing in blue-chip corporate debt is generally considered safe and routine, analysts say some of the companies whose bonds were purchased are currently navigating regulatory landscapes deeply shaped by federal agencies under the president’s authority. The same is true for municipal entities: many rely heavily on federal grants, tax-exempt financing rules, or infrastructure programs that the administration oversees or influences.

Ethics experts emphasize that the issue is not merely whether the president profits from his investments, but whether the public can be confident that policy decisions are made independently of private financial considerations. Federal disclosure rules require presidents to list financial holdings only in broad value categories, which means the public cannot see the exact size of each position or the specific timing of trades. This limits transparency, even when the disclosures follow the letter of the law. According to long-standing norms, presidents have typically placed assets into blind trusts or divested from holdings that could pose conflicts. Trump, however, has opted not to take that step, maintaining direct ownership of the businesses and investments listed in his filings.

The latest purchases also reflect a continuation of a trend that began earlier in his second term: a dramatic expansion of his exposure to municipal debt. Municipal bonds are generally viewed as stable, tax-advantaged investments, especially for high-net-worth individuals. But they also tie investors closely to the fiscal health and political dynamics of specific states and localities. In Trump’s case, the diversity of municipal issuers—from suburban school districts to large metropolitan transit authorities—suggests a wide-ranging strategy designed to balance risk and capture reliable returns. Still, critics argue that when a sitting president holds a large portfolio of bonds issued by entities dependent on federal policy choices, potential conflicts become unavoidable.

Market observers say the timing of the purchases may reflect a bet on shifting interest-rate conditions. With financial markets anticipating eventual cuts in benchmark interest rates, bond prices could rise, making late-year acquisitions potentially advantageous. Whether or not the buying spree reflects a direct view on monetary policy, the scale of Trump’s investment activity signals a clear preference for fixed-income assets during a period of economic uncertainty.

As public reaction continues to build, the disclosures have again highlighted the unusual nature of Trump’s approach to presidential finances. His defenders insist that the investments are legal, routine, and managed in a way that separates them from policymaking. Opponents counter that legality does not resolve the ethical concerns and that the sheer scale of his bond holdings underscores the need for stronger safeguards.

For now, the additional $82 million in bond purchases adds another chapter to a long-running debate about the intersection of wealth, power, and public responsibility. With more disclosures expected in the months ahead, scrutiny over the president’s financial activities—and their potential implications for governance—shows no sign of fading.