India’s widely used digital payment infrastructure, the Unified Payments Interface (UPI), appeared to face intermittent disruptions as users across multiple cities reported transaction failures on popular payment applications. Complaints surged on social media and user forums, with many stating that transfers, QR code payments, and merchant transactions were either failing or stuck in processing stages.

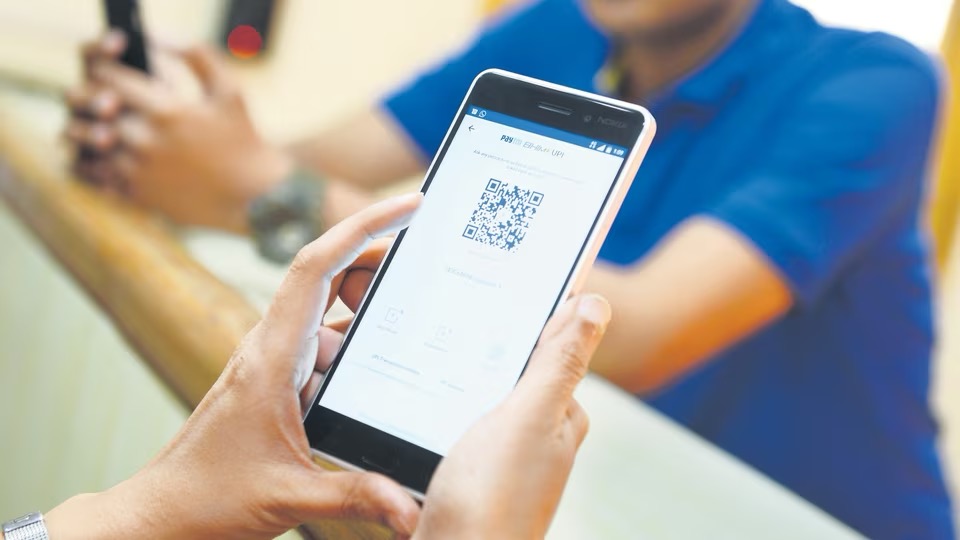

UPI, which powers instant bank-to-bank transfers through mobile apps, has become the backbone of India’s retail digital payments ecosystem. From small roadside vendors to large online platforms, millions rely on UPI every day for fast, low-cost transactions. Any disruption — even brief — tends to have a widespread ripple effect across consumers, businesses, and service providers.

According to user reports, the issues began during peak transaction hours, when payment volumes are typically high. Many users attempting to send money or pay merchants through apps such as Google Pay, PhonePe, Paytm, and various banking apps encountered repeated failures. Error messages varied, with some users seeing “transaction declined,” “bank server not responding,” or “service unavailable” prompts. Others reported that payments were deducted from their accounts but did not immediately reach recipients.

The outage-like situation led to confusion at retail counters and service points where UPI is often the primary mode of payment. Customers were seen attempting multiple retries, switching between apps, or resorting to cash and card payments when digital options failed. Small merchants, who increasingly depend on UPI QR payments, said transaction uncertainty slowed billing and created customer trust issues during the disruption window.

Public transport systems and quick-service businesses that encourage contactless payments also felt the impact. Commuters reported delays while trying to purchase tickets through UPI-enabled kiosks and apps. Food delivery and ride-hailing users similarly flagged failed payment attempts, forcing some to change payment modes at checkout.

As complaints mounted, the phrase “UPI down” began trending across social platforms, with users sharing screenshots of failed transactions and app error notifications. Outage-tracking platforms also reflected a spike in complaints linked to digital payment services, suggesting that the issue was not isolated to a single app or bank but may have involved broader network-level stress or technical faults.

Digital payments experts note that while UPI is built with multiple redundancies, it still depends on a chain of interconnected systems — including issuing banks, beneficiary banks, payment service providers, and switching infrastructure. A slowdown or technical glitch at any point in this chain can cause transaction failures or delays. High concurrency loads during peak hours can further amplify such problems if traffic exceeds handling capacity or if a partner bank experiences downtime.

In situations like these, transaction status mismatches are common. A payment attempt may show as failed on the user’s app but remain pending at the banking layer, or appear debited temporarily before being automatically reversed. Financial institutions generally have automated reconciliation and refund processes for failed UPI transfers, often crediting back the amount within minutes to a few hours, depending on the nature of the error.

Users are typically advised not to repeatedly retry the same payment immediately after a failure, as this can lead to multiple pending debit requests and confusion over final status. Instead, checking transaction history, bank balances, and official app notifications is considered safer. If money is debited without successful credit to the receiver, escalation through the app’s support channel or the user’s bank is the recommended path.

Over the past few years, UPI transaction volumes have grown dramatically, handling billions of transactions every month. The platform’s scale and adoption are widely regarded as a global benchmark in real-time payments. However, this very scale means that even minor technical disturbances can affect a very large number of users within minutes.

Industry observers say occasional slowdowns are not unusual in rapidly expanding real-time payment systems, especially during traffic spikes, major sale events, salary credit days, or festival shopping periods. Continuous infrastructure upgrades, load balancing, and bank-side capacity improvements are necessary to keep pace with growth.

For consumers and merchants, the incident serves as a reminder of the importance of maintaining backup payment options. While digital payments dominate urban and semi-urban transactions, temporary fallbacks such as cards, net banking, or cash remain relevant during network disruptions.

As transaction success rates stabilized later, many users reported that payments began going through normally again, suggesting that the disruption may have been temporary. Payment apps and banks typically monitor such incidents closely and adjust routing or processing loads to restore normal service levels.

UPI continues to be central to India’s digital economy story, enabling instant, interoperable payments at massive scale. Short-lived disruptions, though disruptive in the moment, also highlight the pressure such critical infrastructure handles daily — and the ongoing need for resilience, transparency, and rapid response mechanisms in national payment systems.